How to earn #5: Holding debt in xUSD

May 11, 2022

gm 👋

In this part of How to Earn series, we will explain to you how to maximalize your profits by holding your debt in xUSD.

What is HODLing?

HODLing (Hold on For Dear Life) is a strategy widely enjoyed by investors preferring a long-term approach. It consists in holding the selected asset for...

as you can guess a long term.

What are the risks?

Even though holding can maximize your profits, you have to remember that by holding debt only in xUSD on our platform, you risk losing in case of other synthetics increases. 📈

Why?

When your whole debt is in xUSD, you play against all other synthetic assets. You bet their value will decrease, so you basically play short on them. It is a great way to earn when you’re feeling bearish and think that the token is going to decrease.

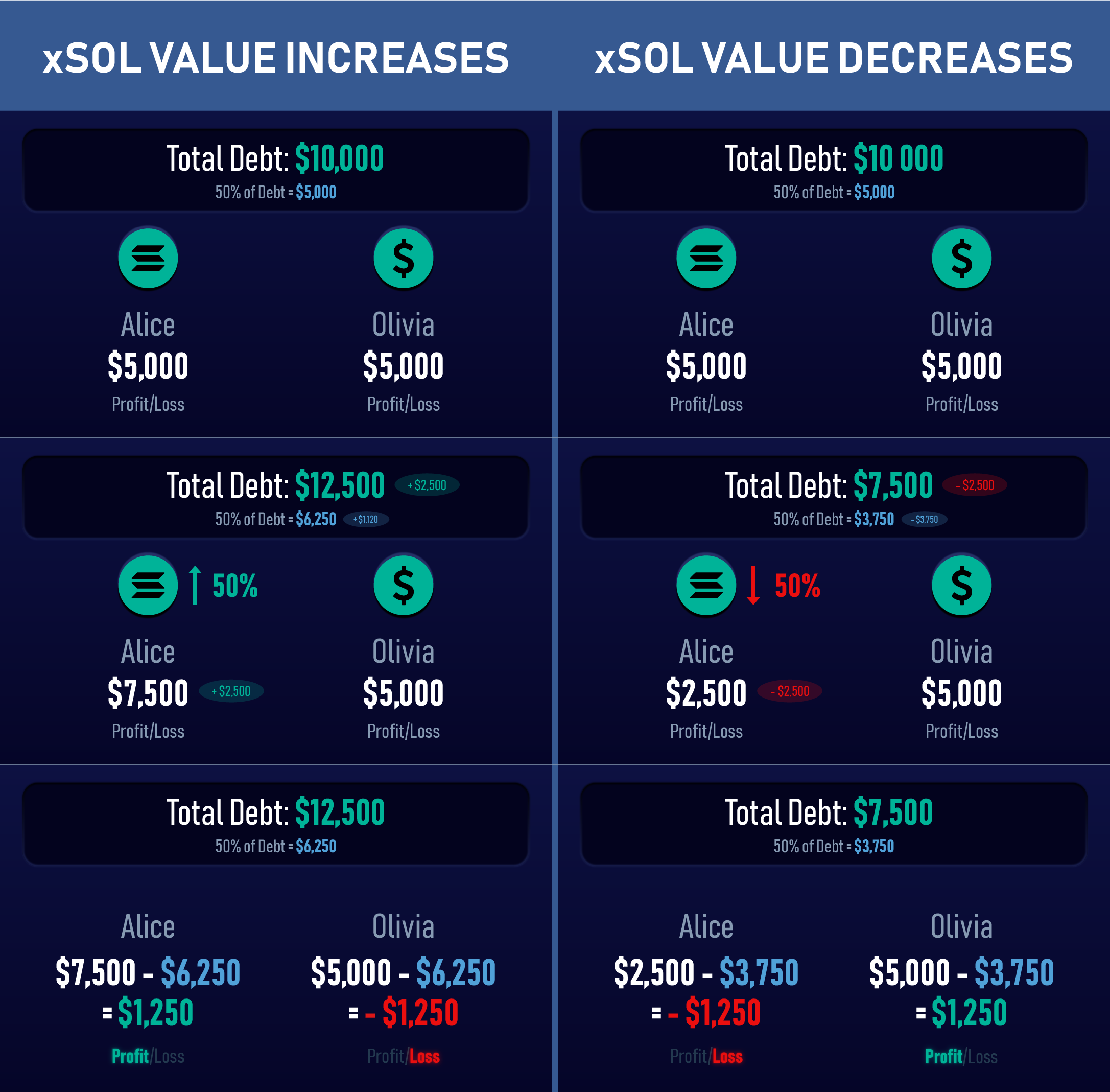

Look at the example which explaining the core mechanism of profits and the risks while participating in the debt pool below ⬇️

Step 1

Both Alice and Olivia have the same amount of debt (50%). Entire debt is equal to $10k. Olivia holds $5k synthetic USD and Alice holds $5k synthetic SOL.

Step 2

The price of xSOL doubles, making Alice’s balance worth $10k. This causes debt to rise to $15k. Olivia still holds xUSD and the value of this token is stable.

Step 3

Both Alice and Olivia are still responsible for the entire debt of the protocol, each of them for 50% of it. Debt increased by $5k, so the debt of Alice and Olivia will rise by $2.5k. When we match positions against owned debt for Alice and Olivia, we get that Alice ended up with $2.5k profit and Olivia lost $2.5k since her debt increased by this amount.

Share on

Home

Tutorial

Application tutorial

Blog

Read the latest updates

Governance

Decide about the future of Synthetify

Privacy Policy

Our policies about data

About us

Whitepaper

Learn more about Synthetify

FAQ

Frequently asked questions

Brand

Company resources

Roadmap

Check our plans for the future

Documentation

Learn more about project

Audit

Security audit report

Community

Discord

Join our Discord server

Visit our Twitter profile

Telegram

Join our Telegram server

Github

Find us on Github

Visit our Linkedin profile

© 2021 Synthetify Labs

Privacy Policy