How to earn #2: Trading with mSOL

January 25, 2022

gm 👋

In the second part of the How To Earn series, we will focus on maximizing your profit using mSOL by Marinade.

What is the difference between mSOL and SOL?

mSOL is a liquid staking token that you receive when you stake SOL on the Marinade protocol. These mSOL tokens represent your staked SOL tokens.

They act as a receipt, allowing you to exchange them back to your staked SOL and the earned rewards.

Meanwhile, you can use mSOL in DeFi, while enjoying your staking rewards.

You can read more about mSOL and Marinade here

How can you earn using mSOL in Synthetify?

Rewards

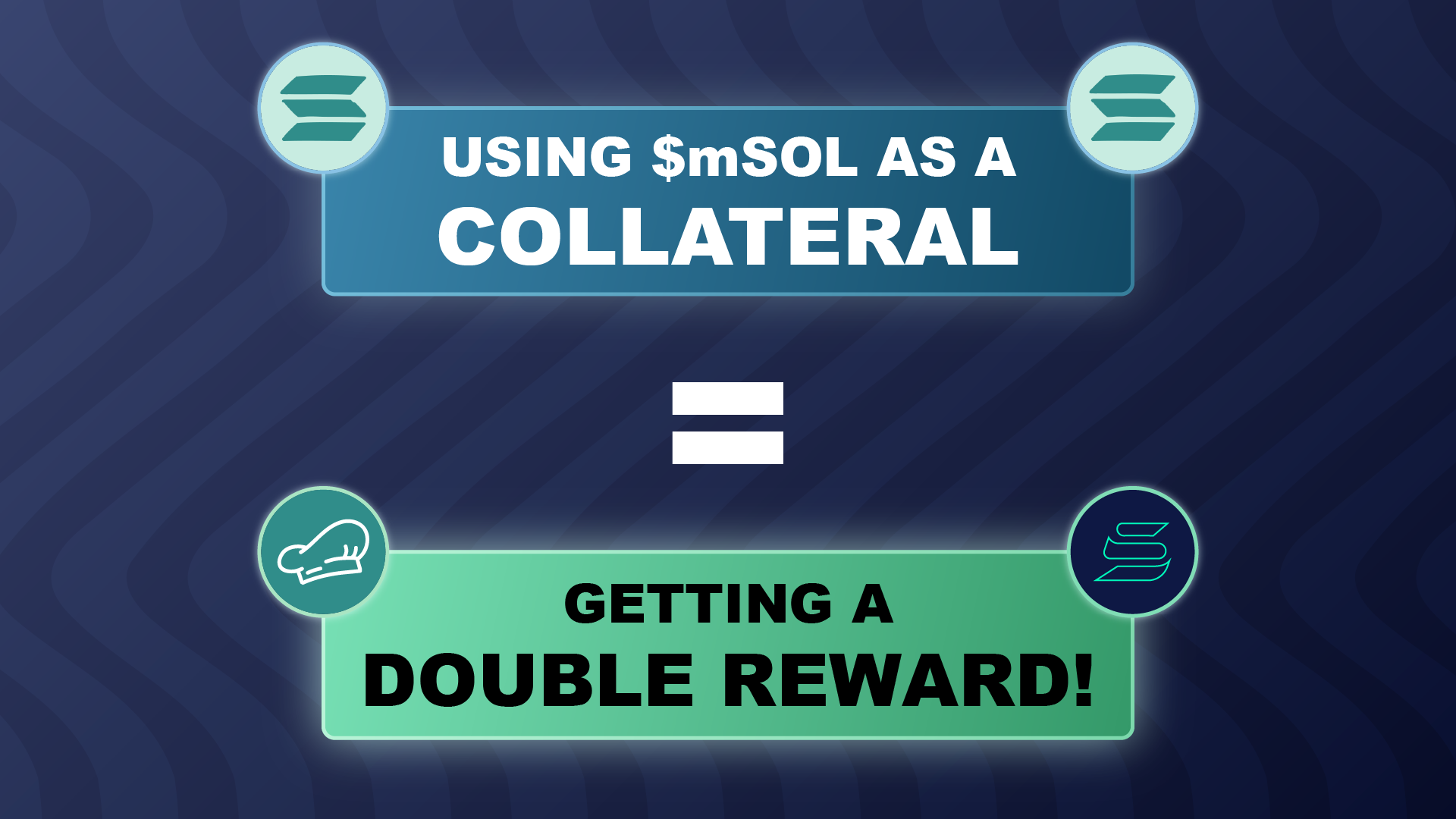

mSOL is a collateral token therefore you can deposit it and mint synthetic assets on our platform, hence you will receive double rewards,

- the first one for participating in the debt pool, paid in $SNY (currently around 12%)

- the second one for using mSOL, paid in $MNDE (currently around 28%)

Remember, that you can mint a synthetic asset for deposited collateral (mSOL in this case) and then you can earn for trading this synthetic asset.

You can learn more about double rewards here

Long/short using borrowing

Not so long ago, we introduced a new feature to our application - borrowing.

You can read more about it here

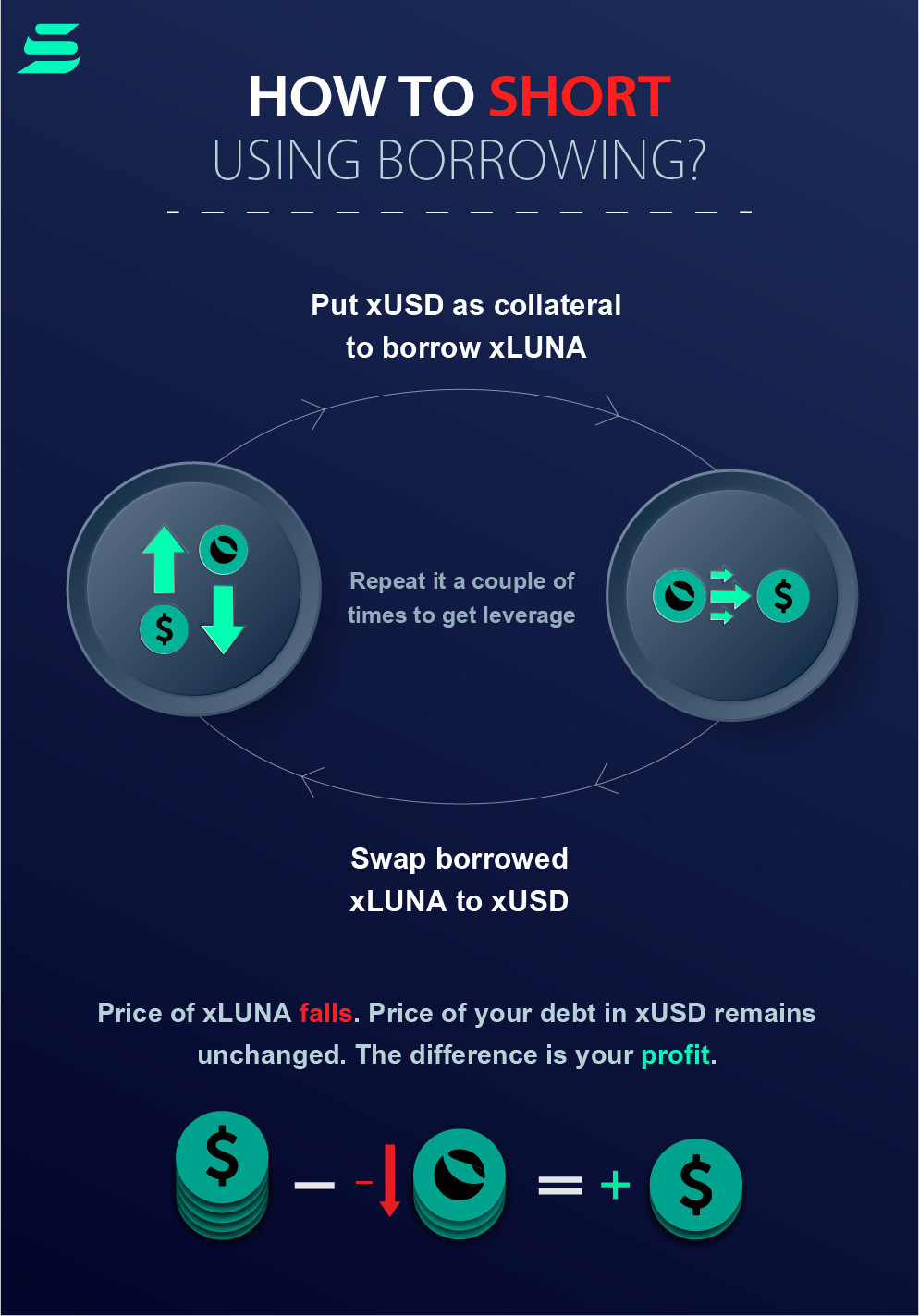

One of the features of borrowing is the ability to LONG and SHORT a single asset.

Self repaying loans

As mentioned above, the APY for mSOL stacking is about 7%. Interest rate for borrowing xSOL is 4%. Therefore, this pair is called self-repaying.

How to use it?

For example, when adding liquidity, the APY for delivering xSOL may be higher than mSOL.

In this case you earn for:

- Staking mSOL

- Participating in the debt pool

- Using mSOL as collateral

- Liquidity mining

Sounds better than just hodl, right? 😎

Share on

Home

Tutorial

Application tutorial

Blog

Read the latest updates

Governance

Decide about the future of Synthetify

Privacy Policy

Our policies about data

About us

Whitepaper

Learn more about Synthetify

FAQ

Frequently asked questions

Brand

Company resources

Roadmap

Check our plans for the future

Documentation

Learn more about project

Audit

Security audit report

Community

Discord

Join our Discord server

Visit our Twitter profile

Telegram

Join our Telegram server

Github

Find us on Github

Visit our Linkedin profile

© 2021 Synthetify Labs

Privacy Policy