Debt pool explanation

June 10, 2022

In this post, we will explain crucial element of our app - debt pool.

What is it, how does it work, and how to use it, to maximize your profit 👇

What is a debt pool

In simple words, debt pool is the total market value of all the minted synthetic assets expressed in USD. Debt pool allows the functioning of a platform and assures its stability.

How does it work

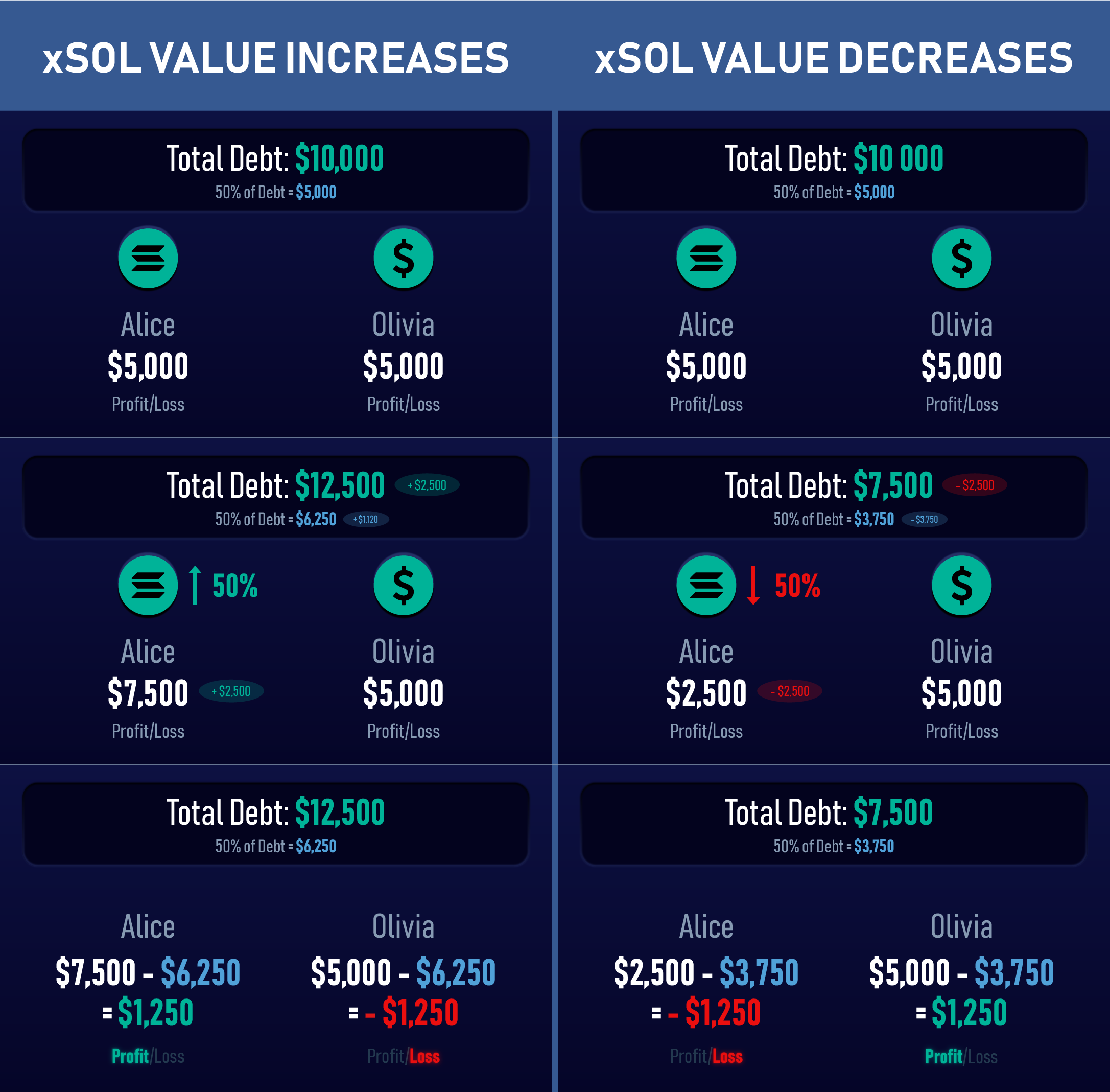

Debt pool participants deposit collateral and mint xUSD (later they can swap xUSD to any other synthetic asset). They become a counterparty to traders and thanks to the funds provided by them make transactions on the platform possible. The share of specific tokens in the debt isn’t constant - it changes accordingly to the market price fluctuations and the amount of users’ staked tokens.

Look at the example which explains the benefits and the risks while participating in the debt pool below ⬇️

Benefits of being a Debt Pool participant

Debt Pool participators on Synthetify get rewards in SNY tokens.

For using stSOL or mSOL as collateral, they can receive an extra reward in MNDE or LIDO.

Of course, apart from the rewards, you can also make a profit if the value of your synthetic assets increases, or if you short them (by holding debt in xUSD) it goes down.

Here you can read more about it👇

How to earn #5: Holding debt in xUSD - Synthetify

The risks

Remember, there is always a risk, especially in the crypto space. As you could see in the graphic above, when someone is on profit on the debt pool, someone else is losing. Always have that in the back of your mind when trading :)

Good Luck! 🤞

Share on

Home

Tutorial

Application tutorial

Blog

Read the latest updates

Governance

Decide about the future of Synthetify

Privacy Policy

Our policies about data

About us

Whitepaper

Learn more about Synthetify

FAQ

Frequently asked questions

Brand

Company resources

Roadmap

Check our plans for the future

Documentation

Learn more about project

Audit

Security audit report

Community

Discord

Join our Discord server

Visit our Twitter profile

Telegram

Join our Telegram server

Github

Find us on Github

Visit our Linkedin profile

© 2021 Synthetify Labs

Privacy Policy